Published: March 17, 2020 Last Updated: February 09, 2022

Coronavirus And Business Success

How to survive and prosper with the Coronavirus pandemic

You can't help see all the doom and gloom out there around the Coronavirus and the impact it will have on the economy. Which then leads to how are you going to ensure your business weathers the storm and comes out the other side ready to grow and take advantage of a recovering economy.

Let history guide us

The best way to decide the strategies you should take is to look at other periods of economic slowdowns and recessions and see what the businesses did that came through strong and then prospered. Fortunately, there have been many different studies around this subject, so the hard work is already done. The best study I found is the Harvard Business Review back in 2010, which looked at three global recessions.

Harvard Business Review: Roaring out of Recession

"...a yearlong project to analyze strategy selection and corporate performance during the past three global recessions: the 1980 crisis (which lasted from 1980 to 1982), the 1990 slowdown (1990 to 1991), and the 2000 bust (2000 to 2002). We studied 4,700 public companies, breaking down the data into three periods: the three years before a recession, the three years after, and the recession years themselves."

From this study, they classified companies into 4 categories depending on how they reacted to the economic slowdown.

Prevention-Focused Companies

These companies essentially looked at cutting costs and investments as much as possible. This meant stopping or reducing marketing, asset acquisition and R&D as well as cutting employees. They wanted to keep their losses to a minimum. Whilst this strategy may have helped them weather the storm (though no better than the other categories), it meant that they lagged well behind other companies when the recovery started as they were starting from further back.

Promotion-Focused Companies

These companies decided to use the slow economy (with reduced prices etc) to try and grow their business by investing in more R&D, assets, marketing and employing more staff. Whilst this may have generated more sales etc, in most cases, the profitability took a hit. It also meant that they could be too optimistic and not really take into account negative impacts, leading to being blindsided by an unexpected occurrence. However, whilst these companies performed better in the recovery stage to the "Prevention-Focused" companies, they didn't perform as well as the last 2 categories.

Pragmatic Companies

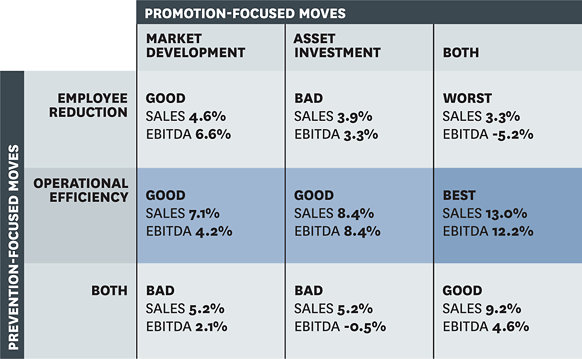

These companies did a combination of the first 2 categories. They cut as many costs as they could, whilst looking for where they could invest money to continue growth etc. They essentially chose the following strategies:

- Reduced employees

- Improved operational efficiencies

- Developed new markets

- Invested in new assets.

Below is a matrix showing the results from these strategies and a combination of each.

Reviewing the best combination of strategies leads to our last category of business and the one that handled the slowdowns the best and had the most successful recovery.

Progressive Companies

These companies used the optimal combination of defensive and offensive strategies. From the matrix above, we can see that these strategies were to look for operational efficiencies, whilst looking to develop markets and invest in assets. So let's look at these strategies in more detail.

Operational Efficiency

One of the largest costs in most businesses is staffing. So the obvious cost-cutting method is to just cut back on staff. However, the biggest issue with this is staff take time to employ and develop, so when you lose staff, you're wasting all that time and money spent recruiting and training them. So when the economic recovery starts, businesses who laid off staff need to spend time and money recruiting and training new staff before they can handle growth. To further impact on this, the cost of this recruitment and training negatively affects their profitability.

By looking at operational efficiencies, you are pulling apart the way you currently do things and working out if there is a better way of doing it. You are looking at ways to make your staff work more efficiently. During a slowdown, this may mean your staff have more time to work on other areas that are often neglected. Furthermore, when the recovery starts, you're ready to take advantage of any opportunity and your business is now more efficient leading to stronger profitability than before.

Invest in Assets

During an economic slowdown, there can often be a drop in prices etc. This may mean that you can invest in assets at a lower amount than you could have before the slowdown. It's the same principle that stockmarket investors use to make money.

Furthermore, with the latest government coronavirus stimulus package, they have increased the instant asset write-off amounts, so you can claim these assets on this year's tax return, making investing in assets even more favourable.

Market Development

So now we get onto something close to our heart. In an economic slowdown, we get a shrinking market, so you should be looking at marketing to increase your market share. Whilst other businesses shut up shop and start cutting costs, you should be marketing to take some of their market share to offset the drop in the overall market. This will not only help you maintain your sales through the slowdown but means your business is primed to grow when the recovery starts.

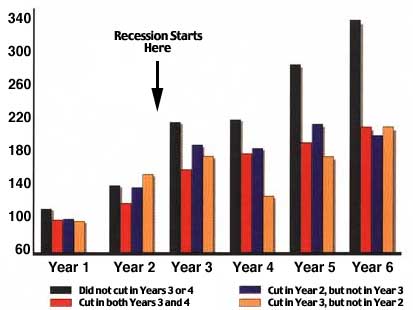

So let's look at this in more detail. Mcgraw-Hill Research did a study of 600 companies across 16 industries for a 6 year period from 1980 to 1985 (the 1981-82 recession), comparing marketing spend and sales. Below is a graph showing the results.

So what does this show? It shows that the companies that performed the best both during and after the recession are the ones that did not cut marketing spend when the recession started. In fact, it shows that these companies way outperformed against the other companies.

So what should you do?

You should take a deep breath and not act too hastily. The business landscape is changing daily at the moment as the Coronavirus pandemic changes and the government responds. So don't do something today, that may not be an issue in a weeks time.

Then take a good look at how your business operates and what you can do more efficiently. At the same time, keep an eye out for any opportunities that you may not have thought about before and start developing a strategy to take advantage of them.

Lastly, keep on marketing!!! You need to increase your market share if you want to maintain your sales, and better still, you'll be in a stronger position when the economy starts to recover than you were before the pandemic. Search Engine Optimisation is all about momentum, so whenever you stop doing SEO, you start to lose momentum and fall back against your competitors.